Presenter(s)

Luke A Bir

Files

Download Project (109 KB)

Description

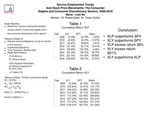

Financial economists consider price movements in stocks a function of both fundamental and macroeconomic factors. In this study, I examine the relationship between U.S. service employment, a large component of total U.S. employment, and two market sectors that rely on consumer spending for sales and earnings growth. Using regression analysis, I regress service employment on the consumer staples SPDR price index(XLP) and the consumer discretionary SPDR price index (XLY). I test the hypothesis that the regression coefficients (B) are greater than zero. The time period for the analysis is 2009-2016, which is also marked by an aggressive policy of monetary easing and a sustained rebound in the stock market.

Publication Date

4-5-2017

Project Designation

Independent Research - Undergraduate

Primary Advisor

Trevor C. Collier

Primary Advisor's Department

Economics and Finance

Keywords

Stander Symposium project

Recommended Citation

"Service Employment Trends and Stock Price Movements in the Consumer Staples and Consumer Discretionary Sectors from 2009-2016" (2017). Stander Symposium Projects. 842.

https://ecommons.udayton.edu/stander_posters/842