Presenter(s)

Reed Thomas Aleck

Files

Download Project (112 KB)

Description

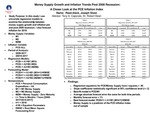

After the 2008 recession, the Federal Reserve initiated an aggressive policy of monetary easing. In this study, I examine the relationship between money supply growth and inflation using Personal Consumption Expenditures (PCE-All) as my measure of inflation. I develop univariate regression models with M1, M2, and MZM as the independent variables and PCE-All as the dependent variable. I test the hypothesis that the slope coefficients are positive and statistically significant (T-Stats > 2). I also forecast 2018 PCE-All inflation rates to determine the forecasting accuracy of the models. My forecasts also take into account the root mean square forecasting error (RMSE).

Publication Date

4-24-2019

Project Designation

Independent Research

Primary Advisor

Tony S. Caporale, Robert D. Dean

Primary Advisor's Department

Economics and Finance

Keywords

Stander Symposium project

Recommended Citation

"Money Supply Growth and Inflation Trends Post 2008 Recession: A Closer Look at the PCE Inflation Index" (2019). Stander Symposium Projects. 1552.

https://ecommons.udayton.edu/stander_posters/1552