Presenter(s)

Christine A. Ferry, Rachel J. Kilbury

Files

Download Project (172 KB)

Description

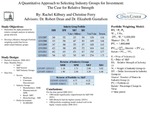

There are 10 S&P sectors and 212 industry groups within these sectors. The industry groups represent a similar mix of stocks in terms of what they reduce and sale. In this study we use relative strength and capture ratio analysis to determine which industry groups are likely to outperform the market. We use 4 industry groups each from the consumer discretionary and healthcare sectors to test our models. Based on relative strength indexes, the first model evaluates whether the most undervalued industry groups outperform their sectors. In the second model, capture ratios in period t are used to evaluate industry group performance in period t + 1. Since the relative strength indexes and capture ratios are calculated on a monthly basis, we will evaluate both models on a monthly, quarterly, and yearly basis for the period 2008-2012.

Publication Date

4-17-2013

Project Designation

Independent Research

Primary Advisor

Robert D. Dean

Primary Advisor's Department

Business-Office of the Dean

Keywords

Stander Symposium project

Recommended Citation

"A Quantitative Approach to Selecting Industry Groups within Sectors for Investment: The Case for Relative Strength and Capture Ratio Analysis" (2013). Stander Symposium Projects. 280.

https://ecommons.udayton.edu/stander_posters/280