Presenter(s)

Anthony Caruso

Files

Download Project (110 KB)

Description

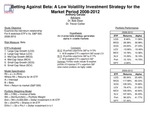

The objective of this study is to examine the risk/return relationships of "style/size" ETFs over the period 2008-2012. The ETFs are (1) Large cap growth, (2) Large cap value, (3) Mid cap growth, (4) Mid cap value, (5) Small cap growth, (6) Small cap value. The measure of risk used in this study is beta. Typically, higher beta ETFs are expected to outperform in up markets and underperform in down markets. Conversely, lower beta ETFs would perform best in a down market and underperform in an up market. The overall period of analysis is 2008-2012. The following three sub periods will also be analyzed: (1) Downswing Period (12-31-07)-(3-31-09), (2) Rebound period (3-31-09)-(12/31/09), (3) Upswing-Trading Range (12-31-09)-(12-31-12). Using monthly data, betas will be calculated for the overall period as well as the three sub periods. In order to carry out the Betting Against Beta strategies, the inverse of the betas will be used as the portfolio weighting mechanism for the 6 ETFs.

Publication Date

4-9-2014

Project Designation

Course Project

Primary Advisor

Robert Dean, Trevor Collier

Primary Advisor's Department

Economics and Finance

Keywords

Stander Symposium project

Disciplines

Arts and Humanities | Business | Education | Engineering | Life Sciences | Medicine and Health Sciences | Physical Sciences and Mathematics | Social and Behavioral Sciences

Recommended Citation

"Research exercise: Betting Against Beta: A Low Volatility Investment Strategy for Market Period 2008-2012" (2014). Stander Symposium Projects. 401.

https://ecommons.udayton.edu/stander_posters/401

Included in

Arts and Humanities Commons, Business Commons, Education Commons, Engineering Commons, Life Sciences Commons, Medicine and Health Sciences Commons, Physical Sciences and Mathematics Commons, Social and Behavioral Sciences Commons

Comments

This poster reflects research conducted as part of a course project designed to give students experience in the research process.