Presenter(s)

Matthew Peter Fazio, Kenneth Christopher Scudder

Files

Download Project (164 KB)

Description

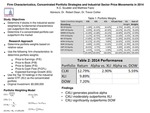

This study is part of a series of studies in the Davis Center for Portfolio Management focused on portfolio weighting. It also considers the alpha generating capabilities of a concentrated portfolio of stocks using relative valuation and momentum stock weighting strategies. The top 10 holdings of the SPDR sector ETF XLI are used as the concentrated portfolio of stocks. Various price-to measures such as price to earnings and price to book are used to develop the weights for each stock in the concentrated portfolio. One year ahead expected earnings growth for each of the 10 stocks provides the basis for the earnings momentum weight component. Assuming the portfolio starts with a funding level of $5,000,000, a performance comparison is made with XLI, the DOW, and the S&P 500 for the year 2014 to determine if the concentrated portfolio generates alpha.

Publication Date

4-9-2015

Project Designation

Independent Research

Primary Advisor

Trevor C. Collier

Primary Advisor's Department

Economics and Finance

Keywords

Stander Symposium project

Disciplines

Arts and Humanities | Business | Education | Engineering | Life Sciences | Medicine and Health Sciences | Physical Sciences and Mathematics | Social and Behavioral Sciences

Recommended Citation

"Firm Characteristics, Concentrated Portfolio Strategies and Industrial Sector Price Movements in 2014" (2015). Stander Symposium Projects. 626.

https://ecommons.udayton.edu/stander_posters/626

Included in

Arts and Humanities Commons, Business Commons, Education Commons, Engineering Commons, Life Sciences Commons, Medicine and Health Sciences Commons, Physical Sciences and Mathematics Commons, Social and Behavioral Sciences Commons