Presenter(s)

Rory T Houser

Files

Download Project (103 KB)

Description

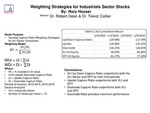

Because of the slow growth globally as well as in the United States after the 2008 recession, the firms in the Industrials Sector(XLI) have experienced uneven and quite volatile stock price performance. In this study, I test a new approach to Portfolio Weighting using the Top 10 Capital Weighted Stocks in the XLI Sector. In particular, I use upside and downside Capture Ratios(U/D) and give higher weights to the stocks with the higher U/D ratios. The argument here is that U/D ratio weighting dampens the price volatility for the overall Portfolio and should increase overall Portfolio returns. Using 2010-2015 as my period of analysis, I test the following hypotheses: (1) The U/D Capture Ratio Weighted Portfolio of Industrial Stocks outperforms the market, 2010-2015 (2) The U/D Capture Ratio Weighted Portfolio of XLI Stocks outperforms the overall sector(XLI) 2010-2015 (3) The XLI Capture Ratio Weighted Portftolio, performance wise, compares favorably to other portfolio weighting strategies

Publication Date

4-9-2016

Project Designation

Independent Research

Primary Advisor

Trevor C. Collier

Primary Advisor's Department

Economics and Finance

Keywords

Stander Symposium project

Recommended Citation

"A Dynamic Pricing Portfolio Weighting Model For the Industrials Sector(XLI) From 2010-2015" (2016). Stander Symposium Projects. 754.

https://ecommons.udayton.edu/stander_posters/754